Rejoice in the Lord always; again I say Rejoice!

~Philippians 4:4

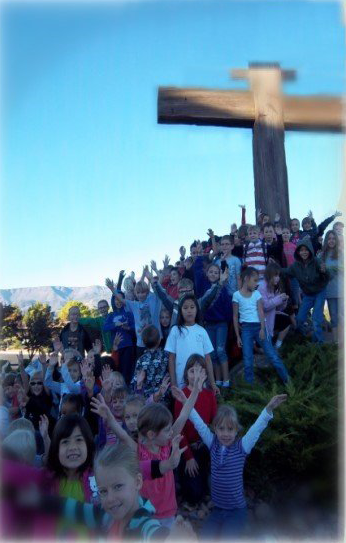

THANK YOU FOR SUPPORTING CHRISTIAN EDUCATION

PROVIDING SCHOLARSHIPS FOR CHILDREN TO ATTEND PRIVATE CHRISTIAN SCHOOLS

NACSSF has been investing in Christian education since 1998. serving Northern Arizona Schools and their families. NACSSF directs donations from contributors to qualified students by awarding scholarships, enabling them to receive a Christian education.

.

Individual Tax Credits

Couples who file Married Filing Jointly can donate up to a total of $2609.00!

Single or Head of Household filers can donate up to a total of $1307.00 (or their tax liability, whichever is less) until April 15, 2024 for tax year 2023.

Once you have donated the full amount allowed under the Original Tax Credit, $1,308.00 Married Filing Jointly, or $655 Single or Head of Household, any additional donated amounts may be applied to the SWITCHER Tax Credit or carried over under the Original Tax Credit up to five years.

Thank You For Supporting Christian Education

Have Questions?

NORTHERN ARIZONA CHRISTIAN SCHOOL SCHOLARSHIP FUND

PO Box 3923

Cottonwood, AZ 86326